Estimated payroll expense

Is income tax an expense or liability. Wave is well-developed software that rivals even some paid programs in terms of features.

Cash Flow Current Year Calculator Use The Cash Flow Calculator To Calculate Your Income And Expenses A Comprehensi Spreadsheet Template Calculator Cash Flow

Estimated business tax payments are due April 30th July 31st and.

. 505 Tax Withholding and Estimated Tax. An unsuccessful bidder may be notified of the award in one of the following manners. Also the amount is excludable from wages and compensation.

A locked padlock or https means youve safely connected to the gov website. The only extra costs to be aware of are payroll payment processing and professional bookkeeping services. The changes were reflected in the 2021 Annual Business Tax filings due February 28 2022.

The 1050 of pay for the hours worked is debited to Wages Expense. Hourly Payroll Entry 1. For more information see Pub.

On January 26 2009 the new rule titled Importer Security Filing and Additional Carrier Requirements commonly known as 102 went into effect. If you are required to make deposits electronically but do not wish to use the EFTPS tax payment service yourself ask your financial institution about ACH Credit or same-day wire payments or consult a tax professional or payroll provider about making payments for you. The software covers all of the accounting basics including invoicing expense tracking accounts payable bank reconciliation and more.

The company then receives its bill for the utility consumption on March 05 and makes the payment on March 25. It is important to keep these documents because they support the entries in your books and on your tax return. These options may result in fees from the providers.

When you figure how much income tax you want withheld from your pay and when you figure your estimated tax consider tax law changes effective in 2022. Federal government websites often end in gov or mil. Share sensitive information only on official secure websites.

View the 2021 Annual Report. How do I obtain bid results of a file that has been awarded. Failure to comply with the rule could ultimately result in monetary penalties increased inspections and delay of cargo.

You should keep them in an orderly fashion and in a safe place. The excess shelter. To record hourly-paid employees wages and withholdings for the workweek of December 25-31 that will be paid on January 5.

Missing quarterly deadlines even by. This rule applies to import cargo arriving to the United States by vessel. The items included are the employers share of FICA the employers estimated cost for unemployment tax.

Example of Depreciation Expense. Under the accrual method of accounting the entry for the transaction should be recorded in the reporting period of February as shown below. Under sections 2302a1 and a2 of the CARES Act employers may defer deposits of the employers share of Social Security tax due during the payroll tax deferral period and payments of the tax imposed on wages paid during that period.

936 Home Mortgage Interest Deduction. A document published by the Internal Revenue Service IRS that provides information on how taxpayers who use. Projected annual deficits increase gradually to a high of 099 percent of taxable payroll in 2044 before declining gradually to 035 percent in 2096.

For instance organize them by year and type of income or expense. In the accounting for a regular US. Companies spent over 92 billion in 2020-2021 on training.

The expense for the utility consumed remains unpaid on the balance day February 28. Definition of Income Tax. These documents contain the information you need to record in your books.

Missing a estimated quarterly taxes payment deadline is fine as long as you pay on the next deadline. The cost of hiring an employee goes far beyond just paying for their salary to encompass recruiting training benefits and more. Even at the expense of thorough.

Before sharing sensitive information make sure youre on a federal government site. To illustrate depreciation expense assume that a company had paid 480000 for its office building excluding land and the building has an estimated useful life of 40 years 480 months with no salvage value. Business Use of Your Home Including Use by Day-Care Providers.

The term salary or wages is defined in the Income Tax Act see section 21 and means income from an office or employmentSalary or wages generally includes any expenditure made in respect of a benefit that would be taxable to the employee under section 6 of the Act see section 30 as well as vacation pay statutory holiday pay sick leave pay pay. You have company ABC with 40 employees and a payroll of 10 million. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

IRS Publication 587. The payroll tax deferral period begins on March 27 2020 and ends December 31 2020. Excess shelter deduction set at the amount by which the households housing costs including utilities exceed half of its net income after all other deductions.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Sigourney Weaver on her unpredictable career With more than 60 film credits including four movies debuting this fall Sigourney Weaver seems to have found her place and at her own steady pace. If you have to make estimated tax payments following the schedule is important.

The gov means its official. An academic paper released last year estimated at least 76 billion in potential fraud. 1 for a sealed bid submit with your bid a selfaddressed stamped envelope and request a copy of the bid tabulation OR 2 for either a fax or sealed bid send an email to the buyer listed on the RFx requesting a copy of the bid tabulation.

The taxable income and the related income tax are found on the corporations income tax return. View the 2021 Merced County Annual Report containing stats demographics key facts news and more. Medical expense deduction for out-of-pocket medical expenses greater than 35 a month that a household member who is elderly or has a disability incurs.

Yes if the employee moved in 2017 and would have been able to deduct the expenses for the move if paid by the employee in 2017 the payment of those expenses by the employer after December 31 2017 is excludable from income as a qualified moving expense reimbursement. In 2021 the HI annual deficitagain expressed as the difference between the cost rate and income ratewas 003 percent of taxable payroll and is expected to rise to 004 percent in 2022. Corporation income tax usually refers to the federal state local and foreign countries taxes that are levied based on a corporations taxable income.

This Quick Reference Guide To Business Taxes Give You A Better Understanding Of Why You Are Paying Cer Bookkeeping Business Business Tax Small Business Planner

Weekly Budget Biweekly Budgetbudget Templatebudget By Etsy In 2022 Weekly Budget Budgeting Budget Planning

Profit And Loss Template Excel Profit And Loss Statement Statement Template Balance Sheet Template

Estimate Spreadsheet Template Startup Capital Calculator Spreadsheet Template Calculator Spreadsheet

Estimate Spreadsheet Template Projected Versus Actual Budget Spreadsheet Spreadsheet Template Budget Spreadsheet Spreadsheet

Expense Printable Forms Worksheets Cash Flow Statement Balance Sheet Template Expense Sheet

Business Budget Template Business Expense Small Business Expenses

Restaurant Payroll Budget Template Google Docs Google Sheets Word Apple Pages Template Net Budget Template Budgeting Payroll

2 Month Budget Template Seven Doubts You Should Clarify About 2 Month Budget Template Payroll Template Payroll Small Business Funding

Get Our Sample Of Payroll Variance Report Template Report Template Budgeting Budget Template

Projected Income Statement Template Elegant 10 Projected In E Statement Template Excel Statement Template Income Statement Profit And Loss Statement

Job Estimate Free Office Form Template Estimate Template Spreadsheet Template Quote Template

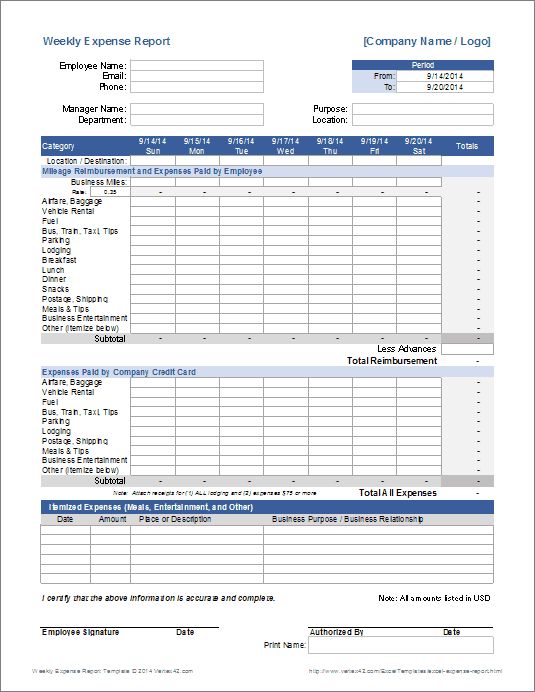

Weekly Expense Report Report Template Report Card Template Templates

Revenue Projection Spreadsheet Cash Flow Statement Spreadsheet Template Cash Flow

Expense Claim Form Templates 7 Free Xlsx Docs Samples Templates Funny Awards Certificates Good Morning God Quotes

Profit And Loss Template For Excel Profit And Loss Statement Statement Template Profit

Budget Calculator Use The Budget Calculator To Calculate Your Annual Budget Including Income Sources Assets And Exp Budget Calculator Budgeting Excel Budget